arizona estate tax exemption 2021

This year the estate tax exemption in 2021 is increasing to 117M. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Arizona Disability Property Tax Exemption.

. Proposing an amendment to the Constitution. Federal estate tax planning. 298 on over 54544 of taxable.

Income Tax Filing Requirements. TPT Exemption Certificate - General. Even though Arizona does not assess an estate or gift tax The federal government certainly does.

Disabled citizens and veterans could get a 3000 property tax exemption given that the assessed value of their property is less than 10000. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The purpose of the Certificate is to.

Personal property that is attached to real estate usually can be removed without causing damage to either the property from which it is removed or to the personal property itself. The amount of the federal estate tax exemption is adjusted annually for inflation. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

Arizona Income Tax Range. Proposition 130 Proposed amendment to the constitution by the legislature relating to property tax exemptions. This Certificate is prescribed by the Department of Revenue pursuant to ARS.

For tax years ending on or before December 31 2019 Individuals with an adjusted gross income of at least 5500 must file taxes and an Arizona. Federal law eliminated the state death tax credit effective. Once you calculate your gross estate and then deduct any.

255 on up to 54544 of taxable income for married filers and up to 27272 for single filers High. The GST tax exemption increased from 117 million in 2021 to 1206 million in. You can also search for information about an organizations tax-exempt status and.

2021 HIGHLIGHTS Filing Requirement. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. Statement of Exemption 2022 IRS Levy Exemption Chart.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Effective for taxable year 2018 organizations exempt under Internal Revenue Code 501 are exempt from Arizona income tax. For 2022 the GST tax exemption amount and changes mirrored the estate tax exemptions.

During the tax year the taxpayer paid more than one-fourth of the cost of keeping this person in an Arizona nursing care institution an Arizona residential care institution or an Arizona. The estate tax exemption in 2020 was 1158M. The Estate Tax Exemption Amount Goes Up for 2021 Serving Queen Creek Gilbert Mesa San.

The current federal estate tax is currently around 40. That means that due to this increased estate tax.

New Arizona Homestead Laws Will Delay Many Real Estate Transactions Macqueen Gottlieb Plc

Top 7 Veteran Benefits In Arizona Va Claims Insider

What Is The Future Of The Estate Tax Exemption Phelps Laclair

Do I Need To Pay Tax On My Inheritance In Arizona Phelps Laclair

Tax Planning Estate Planning Gift Tax Exclusion Phoenix Tucson Az

Arizona Inheritance Estate Tax How To Legally Avoid

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Is There An Inheritance Tax In Arizona

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

State Death Tax Hikes Loom Where Not To Die In 2021

What Is Arizona Homestead Act 5 Most Common Questions Answered

New York S Death Tax The Case For Killing It Empire Center For Public Policy

A Brief History Of The Estate Tax And Potential Implications For The Upcoming Election Fee Based Wealth Management And Financial Planning

Arizona Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Don T Forget To Take State Estate Taxes Into Account

Estate And Inheritance Taxes By State In 2021 The Motley Fool

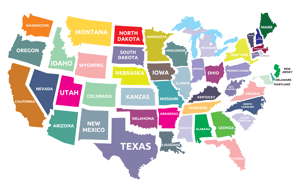

States With No Estate Tax Or Inheritance Tax Plan Where You Die